What is a Loss of Use Policy in Home Insurance?

When buying home insurance, explore available policies. AHI Group customizes coverage in Olathe, KS, including loss of use, which covers extra living expenses.

- home insurance

Jump to Section

When purchasing home insurance, it’s important to look at the various policies that are available to you. At AHI Group, our team likes to design specific policies that will fully insure the people of Olathe, KS. One type of coverage to consider is loss of use, an insurance policy that pays for additional living expenses.

What Situations Require Loss of Use Insurance?

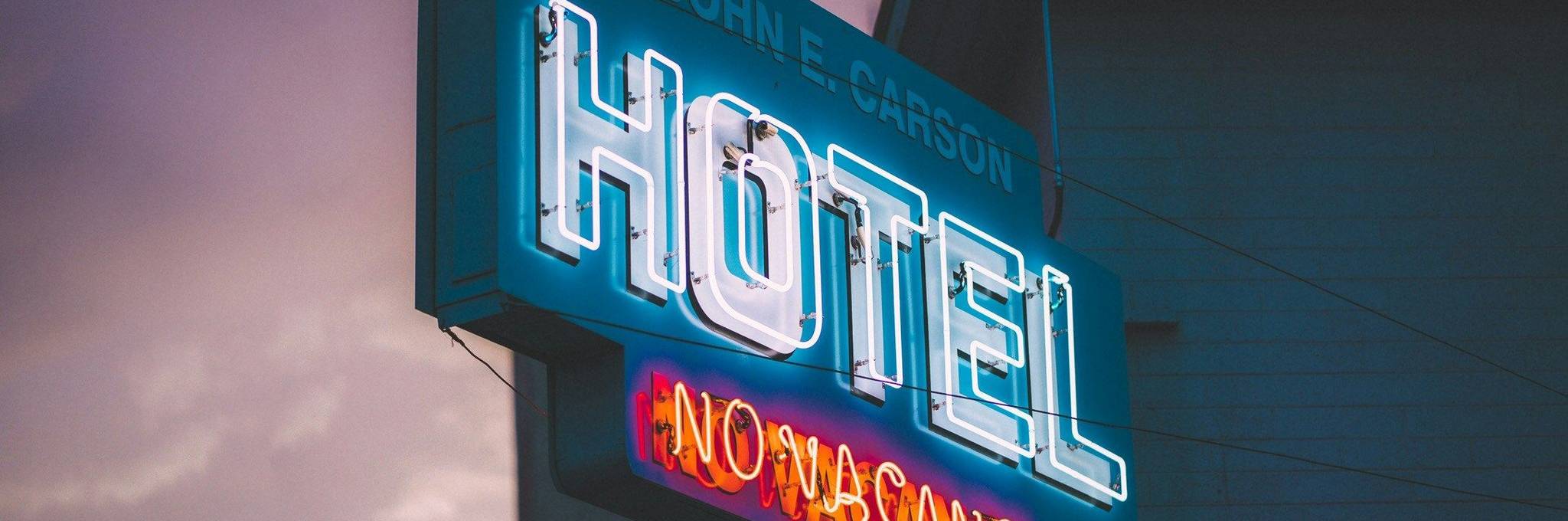

Additional living expenses, also known as ALE, are usually incurred from unexpected life events. If a fire or a storm damages your home, then you might have to move into a temporary residence as your home gets rebuilt. Whether it’s a hotel room or a rented RV, temporary living can be surprisingly expensive – potentially creating new costs for your living situation. For example, if you don’t have a fridge in your temporary home, you might resort to buying restaurant food or quick meals from a convenience store. There could be additional costs from new clothing, health supplies, and beauty products – items that are sometimes lost from property damage.

What Does Loss of Use Cover?

In a home insurance policy, a loss of use policy will cover hotel stays, vehicle fuel, and other necessary expenses while you’re living outside your home. This policy is especially useful if you’re living in a hotel room that is more expensive per month than your actual residence.

Getting Loss of Use in Olathe, KS

If you’re interested in including loss of use in your home insurance plan, then please contact one of our agents in Kansas. You can call the AHI Group to learn more. We offer other types of coverage, so feel free to ask about those policies as well.