Business Interruption and Cyber Insurance: How They Interact

Business interruption and cyber insurance go hand-in-hand, but how? Read on to see how these coverage options interact.

- commercial insurance

- cyber security

In the fast-paced world of business, where every moment counts and every decision matters, the last thing any commercial client wants to deal with is an unexpected interruption. Business interruptions can arise from a variety of sources, whether it’s a natural disaster, supply chain disruption, or in our focus today, the ever-looming spectre of cyber threats.

The reality is that cyber risks are on the rise, and they have the potential to halt your business operations in their tracks. We get it, and we’re here for you. Our mission isn’t just about providing insurance; it’s about empowering you, our valued commercial clients, with the knowledge and tools you need to safeguard your business in this digital age.

At AHI Group, we believe that understanding the connection between business interruption and cyber insurance is not just a business necessity; it’s a promise we make to you, our clients, to care for your interests and provide the support you need to weather the storms that the digital world can bring.

Understanding Business Interruption Insurance

In the realm of business, every moment invested in realizing your vision can be a stepping stone toward success. Business interruption, a sudden and unforeseen disruption to your daily operations can deliver a gut-wrenching blow. Imagine managing a thriving business, steering your team toward your objectives, when suddenly, without warning, disaster strikes. It could be a natural calamity, a critical supplier’s unforeseen hiccup, or, as we delve into today, a cyber incident. The outcome remains consistent – your operations grind to a halt, revenues plummet, and the realization of your dreams feels more distant than ever. Business interruption can be an invaluable inclusion in your overall insurance plan.

The Role of Cyber Insurance

Cyber insurance and business interruption insurance work hand in hand. When a cyber-attack happens that causes your business’s operations to stall, business interruption insurance can be activated to help cover the lost costs during a period of forced closure.

Business interruption coverage in your cyber insurance policy acts as a financial safety net during these turbulent times. It helps cover the income you would have earned had the cyber incident not occurred. It also assists in paying for ongoing expenses like rent, salaries, and utilities. This crucial component can make the difference between a business that manages to weather the storm and one that faces severe financial distress.

The Growing Threat of Cyber Risks

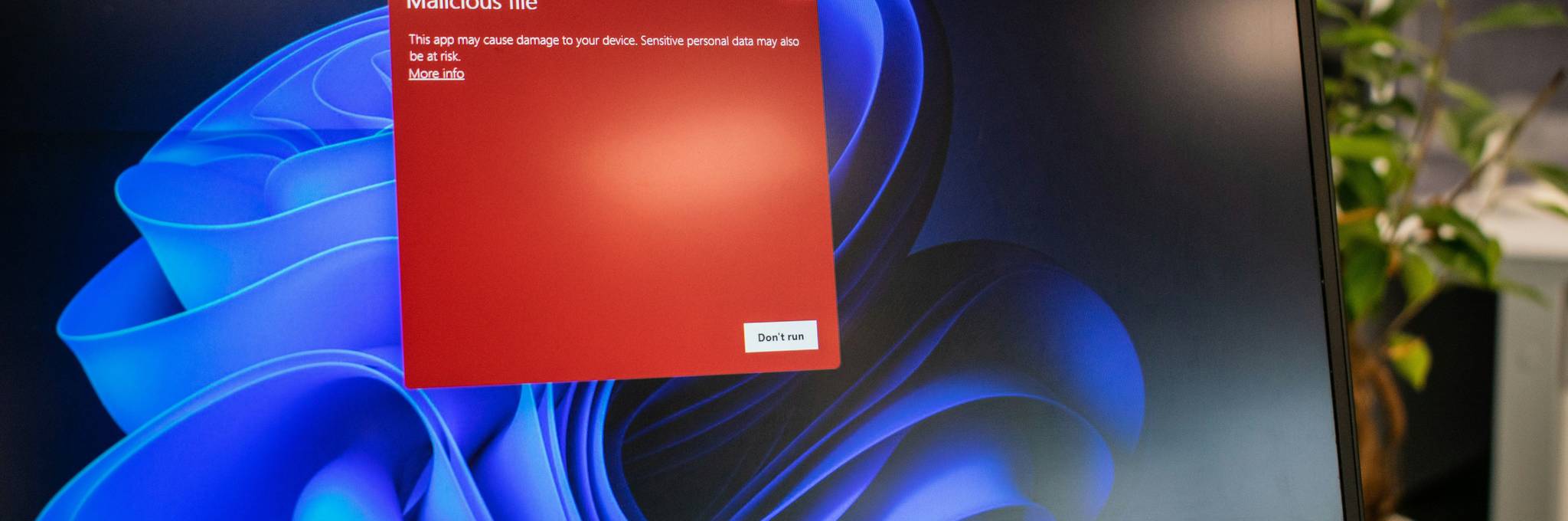

In today’s interconnected world, cyber risks have evolved into a formidable adversary for businesses of all sizes. The digital landscape is bustling with innovation, convenience, and efficiency, but it’s also teeming with lurking cyber threats that have the potential to disrupt, damage, and even dismantle companies. This growing threat is not one that business owners can afford to overlook.

Cyberattacks, including data breaches and ransomware incidents, have become increasingly sophisticated, with cybercriminals constantly refining their tactics. The consequences of a successful cyberattack can be far-reaching, extending beyond financial losses to encompass reputational damage and loss of customer trust. In an era where information is not just an asset but the lifeblood of many businesses, the stakes are incredibly high. Every day, companies are targeted, and while some may have the resources to weather the storm, many others find themselves vulnerable to the devastating consequences of a cyber incident.

Empowering Clients to Take Action

Now that we’ve explored the vital connection between business interruption and cyber insurance, it’s time to shift our focus to empowerment. At AHI Group, we understand that knowledge alone is not enough; it’s the proactive steps you take that truly make the difference in safeguarding your business.

Empowering our commercial clients to fortify their businesses against cyber threats is not just our commitment; it’s our passion. We’re dedicated to providing you with the tools, guidance, and strategies you need to bolster your cybersecurity measures. The journey begins with self-assessment. Take a close look at your current cybersecurity practices and identify areas that may be vulnerable. It might involve evaluating your data security, access controls, employee training, and incident response plans.

That’s where AHI Group’s expertise and guidance come into play. We’re here to assist you in understanding your unique cyber insurance policy, ensuring you know how to navigate the claims process and receive the support you need when the unexpected occurs. We stand by your side during every step of your journey toward resilience and security, because at AHI Group, we’re not just an insurance provider; we’re your partners in success, ready to empower you to face the digital age with confidence and strength. Call us to discuss your cyber insurance strategy today.